Navigating the choppy waters of currency exposure

Currency exposure can significantly impact profitability in the yacht industry, prompting the need for effective currency risk management and structured strategies to mitigate potential risks.

This year’s IYBA/MYBA summit, masterfully orchestrated by Paul Flannery, COO of IYBA, provided me with an incredible opportunity to learn from influential industry stakeholders and better understand how Centtrip aligns with the industry. I am thus enthusiastic to share my observations on the sector’s trajectory, and the role that the FX market plays in this.

Foreign Exchange markets’ impact on profitability…

The currency markets have experienced significant volatility in recent years. If as an example we take the EUR/USD pair, which tends to be the heavyweight traded pair in the superyacht sector, we notice that the exchange rate has moved over 16% in the last 8 months. Most clients would wince at the thought of an additional $1.6 million in costs for a 10-million-dollar build due to unforeseen external forces.

It is clear that currency can significantly impact profitability of transactions.

Given the current market forces and US monetary policy, the same 16% could quickly exceed 20% over the next quarter. This is something Centtrip is actively addressing with clients by implementing measures to mitigate potential risks.

More about how we help…

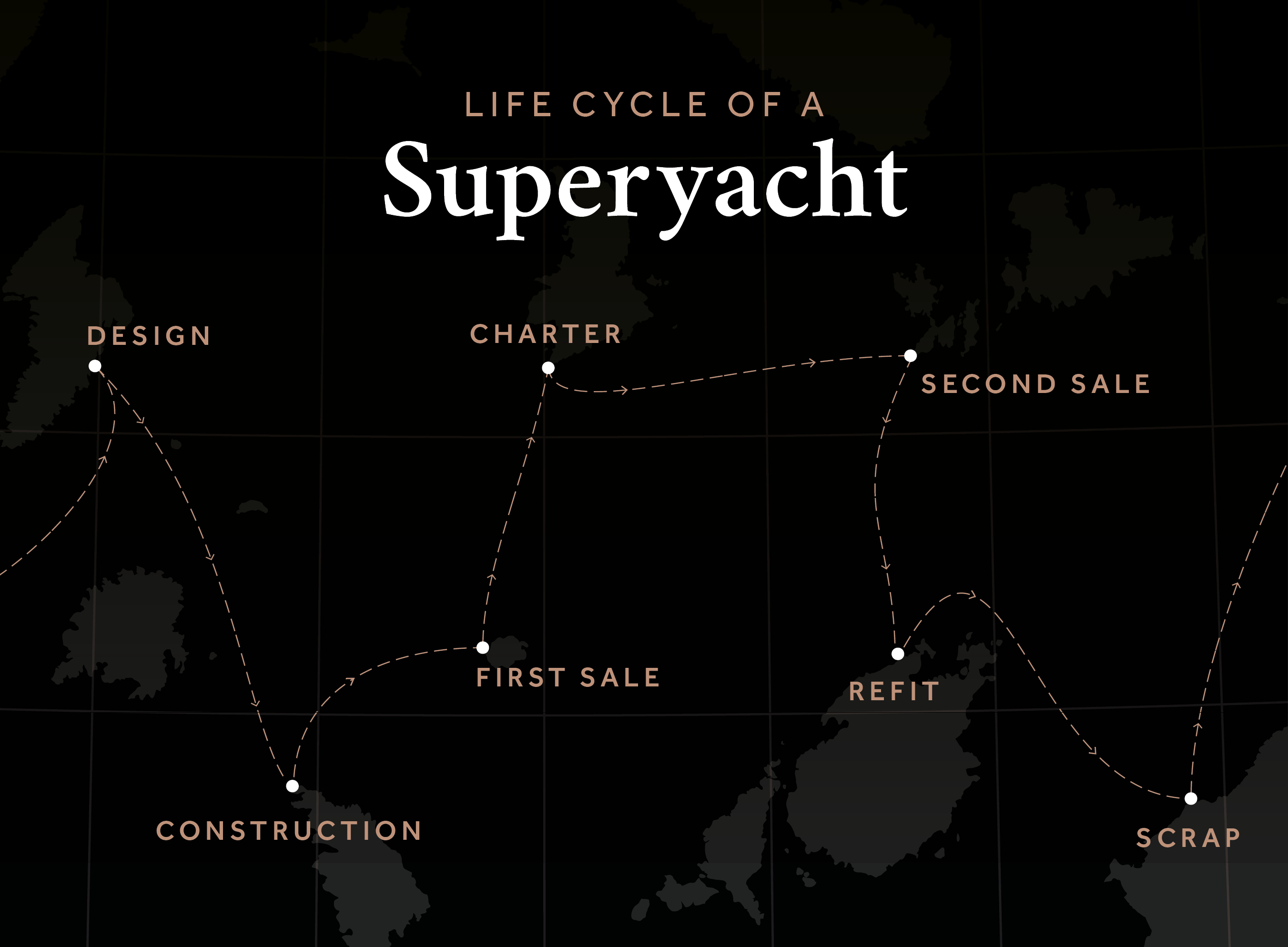

Centtrip is well-known in the industry as an award-winning provider of card payment and spend management solutions for yacht operations and charter management. We service many transactional points in a yacht’s lifecycle, from sales and purchase exposure, charter and APA management, to ongoing operating costs.

As clients increasingly integrate Centtrip up and downstream within the yachting ecosystem, we are discovering many areas where currency risk has not been proactively managed in the past. Sometimes, it has been completely overlooked or neglected.

The old misconception that the yachting industry is price inelastic is wrong, as acknowledged by many attendees at the conference. The prospect of saving over 10% on a refit, yacht build, or charter negotiation, among other areas, would be warmly welcomed.

The industry has come to realise that effective currency risk management is increasingly important at every stage of a yacht’s lifespan.

Considering the example below of a typical yacht lifecycle, the need for currency management becomes even more obvious:

Yacht design, quoted in EUR by a design company based in Monaco.

Implementation of build quoted to US client in USD.

Build contract extends 3 months due to legal back and forth on requirements.

EUR/USD moves 4% in this timeframe.

3 years on, the boat is being sold with tentative buyer interest in EUR, HKD, and AED.

New buyer demands a refit to update the yacht to more eco-friendly standards

Raw material costs increase due to export country currency appreciation, e.g. steel from Japan, fabrics from India etc.

Besides, due to the growing emphasis on sustainability in the industry, it is expected that refits will increasingly lean towards more environmentally friendly constructions. As a result, the frequency of these refits is likely to rise. Working closely with our yachting clients, Max Heale, FX Lead for Centtrip Marine, has observed the successful implementation of hedging structures to safeguard costs during yacht refits.

Speaking with Simon Turner from Sunreef Yachts, a renowned manufacturer known for their exceptional eco yacht design, he felt strongly about the importance of addressing sustainability. Simon believes that new regulations are fast approaching, and it is the industry's responsibility to proactively stay ahead of these developments.

Although the outlook for design, build or refits may change over the next five to ten years, the need for effective currency strategies, and structured risk management, will continue to dominate profit and loss as owners and operators seek to contain fluctuating costs.

If you would like to learn more about how Centtrip can support in effectively managing your exposure risk, and potentially reducing your costs, please reach out to myself, or the team.

Want to know more?

If you’d like to know more about our approach and services, please get in touch today.